Introduction

Financial technology, or fintech, is rapidly transforming the banking and financial services industry worldwide. Traditional banking models are evolving as digital-first platforms, mobile payment solutions, and blockchain technology redefine how consumers and businesses interact with money. Fintech innovations are not only enhancing convenience but also driving financial inclusion and operational efficiency across global markets.

In 2025, digital banking has moved beyond simple online transactions. AI-driven platforms, biometric security systems, and advanced analytics are enabling banks to provide personalized services, predictive insights, and faster, safer financial operations. The rise of fintech is reshaping customer expectations, regulatory approaches, and the competitive landscape for financial institutions.

Digital Banking Adoption

Consumers are increasingly shifting toward digital banking solutions. Mobile banking apps, online payment platforms, and neobanks offer convenience, accessibility, and real-time transaction capabilities. These solutions allow users to manage accounts, transfer funds, and monitor spending from anywhere, often without visiting a physical branch.

Emerging markets have seen particularly rapid adoption of digital banking. In regions with limited access to traditional banking infrastructure, mobile-based fintech solutions are enabling financial inclusion, giving millions of people access to savings, credit, and payment services for the first time.

AI and Data Analytics in Banking

Artificial intelligence and data analytics are driving the evolution of modern banking. AI algorithms can analyze customer behavior, detect fraud, and optimize lending decisions. Predictive analytics allows banks to anticipate client needs, recommend tailored financial products, and improve risk management strategies.

AI-powered chatbots and virtual assistants are transforming customer support. They provide instant assistance, resolve queries, and guide users through complex banking operations, enhancing both satisfaction and operational efficiency.

Blockchain and Cryptocurrency

Blockchain technology is revolutionizing the financial sector by enabling secure, transparent, and decentralized transactions. Cryptocurrencies and digital assets are gaining mainstream adoption, offering alternatives to traditional fiat currencies.

Banks and fintech startups are experimenting with blockchain for cross-border payments, smart contracts, and decentralized finance (DeFi) platforms. These innovations reduce transaction times, lower costs, and increase transparency, fundamentally altering the way financial services are delivered.

Fintech and Financial Inclusion

One of the most significant impacts of fintech is its role in promoting financial inclusion. Mobile wallets, peer-to-peer lending platforms, and digital microloans are empowering individuals and small businesses who previously lacked access to formal financial systems.

By reducing barriers to entry, fintech fosters economic growth, supports entrepreneurship, and provides opportunities for underbanked populations worldwide. Governments and NGOs are partnering with fintech firms to expand access to essential financial services in underserved regions.

Cybersecurity and Regulatory Challenges

As fintech grows, security and compliance have become critical concerns. Digital banking platforms are prime targets for cyberattacks, making encryption, multi-factor authentication, and continuous monitoring essential. Banks must invest heavily in cybersecurity measures to protect customer data and maintain trust.

Regulatory frameworks are also evolving to accommodate fintech innovations. Governments worldwide are implementing guidelines for digital banking, cryptocurrency trading, and cross-border payments. Navigating these complex regulations is vital for fintech companies to operate legally and sustainably.

Customer Experience and Personalization

Digital banking is increasingly focused on delivering personalized experiences. AI-driven analytics allow banks to understand user behavior, offer tailored financial advice, and recommend products suited to individual needs.

Personalization extends beyond product offerings. Notifications, budgeting tips, and financial planning tools help users manage their finances more effectively, creating loyalty and long-term engagement with digital platforms.

The Rise of Neobanks and Challenger Banks

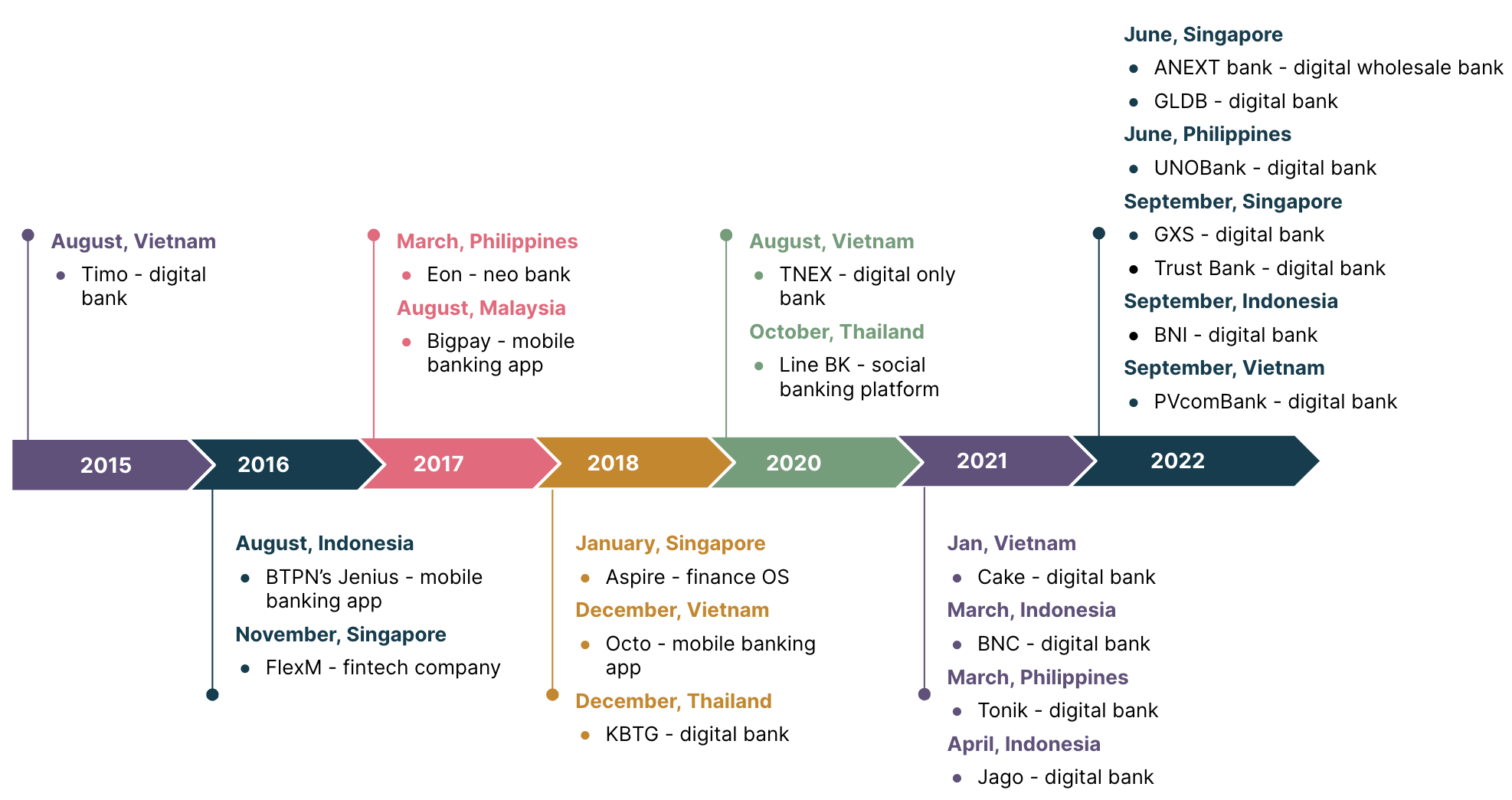

Neobanks and challenger banks are disrupting traditional banking by offering fully digital services without physical branches. These institutions prioritize user experience, fast onboarding, and low fees, attracting younger and tech-savvy customers.

Neobanks are also leveraging partnerships with fintech startups to integrate investment platforms, insurance products, and loyalty programs into their apps, creating a comprehensive digital financial ecosystem.

Global Investment in Fintech

Investment in fintech continues to grow exponentially. Venture capital and private equity firms are funding startups that specialize in digital payments, blockchain solutions, AI-driven finance, and cybersecurity. This inflow of capital accelerates innovation and drives competition, ensuring rapid development of new financial technologies.

Countries like the United States, China, and India are leading in fintech investments, while emerging markets are adopting innovative solutions to overcome traditional banking challenges. The global fintech landscape is increasingly interconnected, with cross-border partnerships and collaborations fueling growth.

Future Outlook

The future of fintech points toward deeper integration with AI, blockchain, and immersive technologies like virtual reality. Financial institutions will continue to leverage data analytics to enhance customer experience, predict market trends, and streamline operations.

Digital banking is likely to become the default model, with physical branches serving specialized needs. Fintech innovations will continue to promote financial inclusion, reduce costs, and improve transparency, reshaping the global economy. Organizations that embrace these technologies while maintaining regulatory compliance and cybersecurity standards will gain a competitive edge in the evolving financial landscape.

FAQs

What is digital banking?

Digital banking refers to financial services delivered primarily through online platforms and mobile apps, allowing customers to perform transactions, access accounts, and receive personalized services.

How does AI improve digital banking?

AI enhances customer service, fraud detection, lending decisions, and financial planning by analyzing data and providing predictive insights.

What role does blockchain play in fintech?

Blockchain enables secure, transparent, and decentralized transactions, supporting cryptocurrencies, smart contracts, and cross-border payments.

Are neobanks replacing traditional banks?

Neobanks complement traditional banks by offering fully digital services, better user experiences, and lower fees, appealing especially to younger demographics.

How does fintech promote financial inclusion?

Fintech provides mobile wallets, microloans, and digital payment solutions to underserved populations, expanding access to essential financial services.

Conclusion

Fintech is revolutionizing global banking by introducing efficiency, innovation, and inclusivity. AI, blockchain, and digital-first platforms are reshaping customer experiences, enabling secure transactions, and fostering economic growth worldwide. Digital banking is now central to how individuals and businesses manage finances in an increasingly connected world.

However, technology alone cannot guarantee success. Financial institutions must balance innovation with cybersecurity, regulatory compliance, and ethical practices. The future of digital banking will be defined by the collaboration of technology and human expertise, creating secure, accessible, and personalized financial ecosystems for a rapidly evolving global economy.